Introduction

You have pitched to investors and some of them are interested. If you’re a small business entrepreneur or owner & have just been handed a Series A Term Sheet by an investor, whatever you don’t sign it just yet.

This is simply because issuing a term sheet is a nerve-wracking moment for a VC because it only happens a few times per year, and each time, the whole firm is watching to see if that partner can convince you to sign.

Many business founders have been overwhelmed by the numbers and signed a term sheet that was not in their favor. In the old days, term sheets only came from Venture Capitals. Founders were almost always selling.

Please take this hard-earned lesson to heart: your goal as a wise CEO is not to achieve the highest valuation for this one round.

Your goal is to find a VC who is willing to invest enough money for your plan, on market terms, and is someone you will want to work with for many years to come.

So, before going into concrete negotiations, it is time to learn everything about the term sheet and its commonly used clauses. I will explain more about the series a term sheet that will help you to gain an insight into the terms and actual scenarios.

Funding is the fuel that every business runs on. Knowing the ins and outs of funding is therefore essential if you want your startup to be successful.

–Jeroen Corthout(Co-Founder Salesflare)

What is a Series A term sheet?

A Term Sheet is a non-binding agreement that entails the basic terms and conditions under which an investment will be made.

It’s not a legal promise to invest; the actual investment contract is drafted later, based on the term sheet. Hence, I will suggest consulting with your lawyer while reviewing your term sheet.

So, why are investors going to hand over a Series A term sheet? Series A term sheet will serve as the blueprint for the succeeding funding rounds.

It helps the investors in understanding the favorable provisions to you or identifying mistakes that could result in loss of control or a smaller payout in the event of an acquisition.

Hence, it details what you as the start-up are giving, what you are getting in return, who will control it, and who will profit the most if the company is sold or goes public.

Now you have a Series A term sheet in your hand. What’s next? As you are the first-time founder, I will help you in navigating through the elements that are generally included in the series A term sheet.

“The most important term in the term sheet is not a legal one — it’s really who you’re working with,” quoted by Andrew Beeb managing director of San Francisco investment firm Obvious Ventures.

What does a term sheet include?

Always remember, no two investors’ Series A term sheets are exactly alike, they do tend to follow similar outlines. Some Important Elements of the Term Sheet are:

-

Valuation

Valuation determines how much money is being invested, how much of the company the investor will own. This aspect affects who owns what, and how much money each shareholder will earn when the business is sold.

Valuations can be either pre-money valuation or post-money valuation.

Pre-Money Valuation

It is the Valuation of the company before the investment.

Post-Money Valuation

It is the Valuation of the company after the investment.

Formulas:

Pre-money valuation = Post-money valuation – New investment

Post-money valuation = Number of shares a company has after investment * Price per share at which the investment was made.

If an investor mentions a valuation without stating whether it’s pre-money or post-money, make sure to ask him to clarify.

A VC will usually mean post-money valuation. Therefore, a lower valuation from a great VC may be better than a higher valuation from a bad VC.

-

Option Pool

The Option Pool is the term used to refer to an amount of equity reserved for future hires and its impact on valuation.

Let’s consider the difference between a $1m investment at a $3m pre-money valuation i.e no option pool and the same investment with a 15% option pool established pre-money with an option pool.

| No Option Pool | Option Pool | |||

| Founder | $3,000,000 | 75% | $2,400,000 | 60% |

| Pool | – | – | $600,000 | 15% |

| Investor | $1,000,000 | 25% | $1,000,000 | 25% |

| Total | $4,000,000 | 100% | $4,000,000 | 100% |

I will advise you to keep an option pool of 15% that provides for sufficient room to incentivize and attract key employees.

-

Liquidation Preference

The liquidation preference sets out who gets paid first and how much they get in the event of a liquidation, bankruptcy, or a sale.

This is the name given to downside protection for preferred stock. By including liquidation preferences, venture firms try to protect their investments from downside risks, by making sure that they get their investment back before any other shareholders.

Now imagine that an investor invests $500,000 in preferred shares with a liquidation preference of 2x in the company.

If the company gets sold for $2,000,000 the investor will receive $1,000,000 (2x $500,000) and the regular shareholders (common share) will divide the remaining $1,000,000 amongst themselves.

But if the investor had invested $500,000 as a preferred (2x) and additionally invested $500,000 in regular stock representing 50% of the common shares.

The investor would have received $1,000,000 due to the liquidation preference and 50% of the remaining $1,000,000 due to her ownership of the common shares.

Thus at the sale there only remains $500,000 for the other shareholders despite selling at $2,000,000. So, always make sure that the Actual Preference multiple is 1x. If it’s not, find out why.

-

Board of Directors & Employees

Initial equity financing would be a three-person board with two founders as representatives of the common stock and one investor representative.

Now you might be thinking that in some cases the company’s having one or more independent directors means directors that don’t hold any of the company’s equity & don’t have any other material interest in the company, which adds complexity to the analysis.

Always remember a rule which is important for early-stage boards is that the common holder’s and investors’ representation on the board should reflect the relative control of the cap table (A cap table tells you “who owns what”).

Be careful to give the Venture Capital enough influence without complete control, keep in mind that board members can sway the board’s vote. Remember that board members do not get a salary.

Let’s consider: If Series A investors include a clause in the term sheet for a 10% option pool to be fully diluted post-money.

In the case of a $2 million post-money valuation, the option pool would be equal to $200,000. Hence that’s a lot of equity removed from the entrepreneur’s portion of the cap table.

The typical option pool for future board members and future employees is 10–15%.

-

Founder Vesting Period

Vesting refers to the distribution of employee options or founder stock over a set period. Try to understand this from the founder’s perspective.

Founder Vesting rights should be based on :

-

- on what date does vesting commence?

- does vesting accelerate upon termination without cause?

- does vesting accelerate upon a change of control or the termination of employment without any cause within some period of time after a change of control?

Likewise, If an employee or founder leaves before the vesting period, he/she does not get the full amount of stock. The industry standard for early-stage companies is a one-year cliff with four-year vesting.

Therefore, if you leave before the first year is up, none of your stock is vested, and at the one-year mark 25% of your stock is vested – after which you begin vesting monthly or quarterly, or annually over the remaining three years.

-

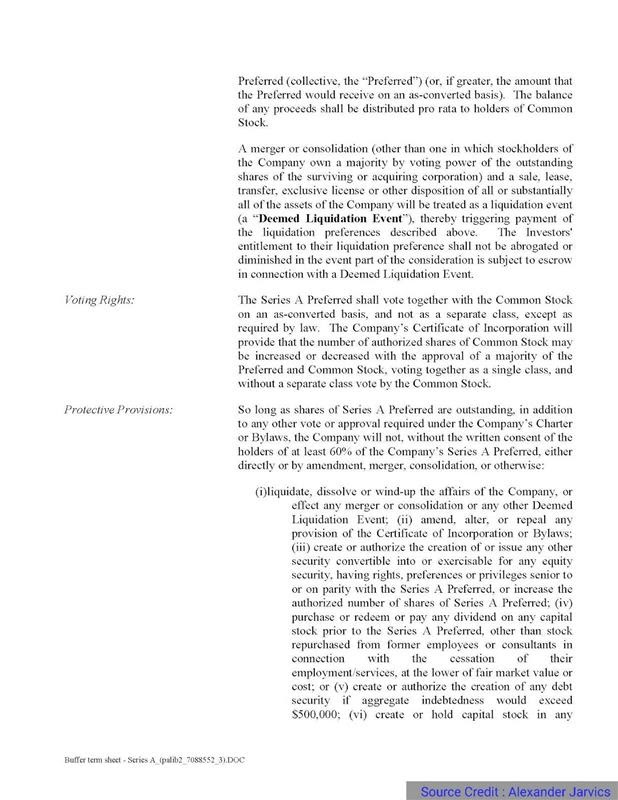

Voting Rights (Preferred vs Common shares)

Voting rights are very important as they determine who controls the company. One of the decisions in terms of long-term impact is voting rights for preferred shareholders compared to common shareholders.

The main difference between the two is that preferred stock usually does not give shareholders voting rights, while common stock does, usually at one vote per share owned.

Now let’s see how voting rights are split up:

- Series A preferred holders (voting as a separate class) can elect one member of the company’s board of directors.

- Common stockholders who are usually founders can elect one member to the board.

- The remaining directors are selected either:

- (If the VC controls more than 50% of the capital stock) by the preferred and common, or

- (if the VC controls less than 50%) by the mutual consent of the board of directors

For example, Detour Gold Corporation, a former Canadian gold mining company, interim CEO Michael Kenyon resigned following a vote by shareholders and hence the company took an entirely new direction because of common stock shareholders.

-

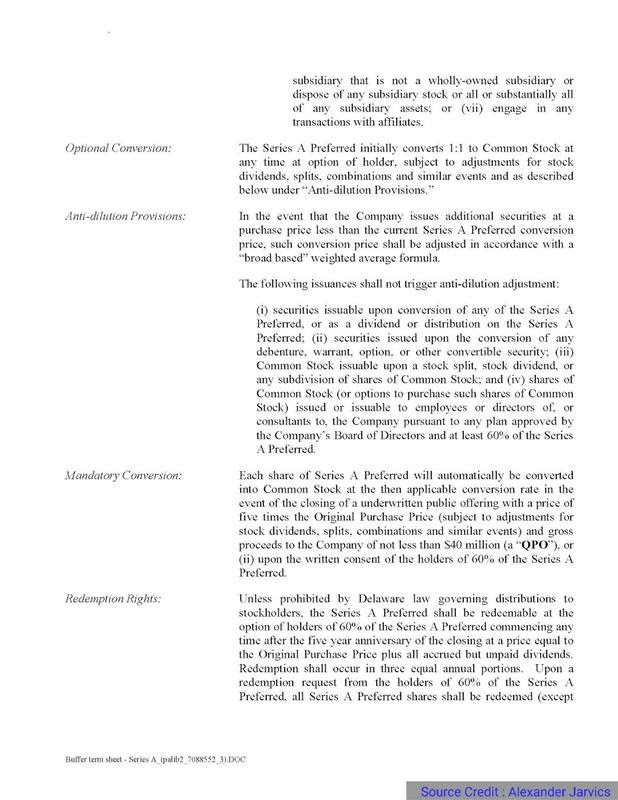

Anti-Dilution Protection

An anti-dilution provision is employed to guard investors in the event a corporation issues equity at a lower valuation than in previous financing rounds.

They are mainly divided into two subparts- weighted average anti-dilution and ratchet-based anti-dilution. So as we are in a Series A round negotiation.

Ratchet anti-dilution –

Ratchet means that if a company issues new shares in the future at a price below the price of the Series A, the Series A price is reduced to the lower price.

Now you must be wondering what does that means?

Let’s Say you originally have a company with 100,000 shares and a share price is $10 per share. You now issue 100,000 shares in your Series A at the price of $10 per share representing an investment of $1,000,000.

At the end of Series A, you will hold 100,000 shares out of a total of 200,000 representing 50% of the company.

If the Series A price gets repriced to $9 per share, the investment remains $1,000,000 but they now represent 111,111 shares whose ownership is decreased to 100,000 / 211,000 or 47%.

Weighted average anti-dilution –

This takes into account the magnitude of the lower-priced issuance, not just the actual valuation.

If a corporation sells shares of its stock to someone for a sale price less than the previous conversion price, the previous round stock is repriced following the number of shares issued at the reduced price.

NCP = OCP * ( (CSO + CSP) / (CSO + CSAP))

NCP = new conversion price

OCP = old conversion price

CSO = common stock outstanding immediately before the new issue

CSP = common share purchased if the round wasn’t a down round (at Series A pricing)

CSAP = common shares purchased because the round is down.

One important thing you should remember is that ratchet-based anti-dilution provides investors with more control and should be reserved for smaller-scale investors (angels) when there is more risk of a subsequent down round.

Otherwise, weighted average narrow-based provisions are preferable.

-

Redemption Rights

Redemption Rights gives investors the right to have their outstanding shares redeemed by the company at a specified price. This requires the approval of a majority of shareholders.

These rights provide VCs with additional protection, particularly in cases where a company is successful enough to be an ongoing business but not quite successful enough to be acquired or go public.

This also provides a liquidity path for the VCs, which helps a VC invest in year five of the fund’s 10-year life span.

Typically the company will pay the redeeming party the greater fair market value and the original purchase price plus any interest rate (of around 5% – 10%).

-

Dividends

Now first let’s look at what are dividends. A dividend is a sum of money paid regularly i.e quarterly by a company to its shareholders out of its profits or reserves.

Brad Feld a VC at Foundry Group quoted as “For early-stage investments, dividends generally do not provide “venture returns”

Series A investors are looking to generate huge returns so 5-15% on investment is simply a little added “juice.”

-

Pro-Rata Rights

These are the rights of an investor to buy shares in future financing. Hence they give investors the right, but not the obligation, to maintain their level of ownership throughout subsequent financing rounds.

They are also called pre-emption rights, anti-dilution provisions, or subscription rights.

Let’s consider that you have 100 shares and you sell 10 shares to an investor with pre-emptive rights. If you now issue 500 additional shares, the investor will have the right to buy 50 shares at the same pricing as others.

The danger in granting them is that in later rounds you might find investors that are only willing to come into your company if they can acquire a sizable portion of equity.

As this might lead to you getting unwanted investors as shareholders, it is not uncommon to include language that prevents investors from doing so.

-

Exclusivity

Investors don’t want companies to leverage their term sheets to get a better deal elsewhere, so they will often institute an exclusivity period, during which the company cannot court other investors.

Thirty days is standard, although investors will occasionally stipulate up to 60 days. Beware of an exclusivity period that is longer than that or of a term sheet that doesn’t set a time limit at all.

“I prefer to discuss as many key terms as possible during the term sheet stage or even before if the investor is asking to help ensure both parties are on the same page,”

–Shanna Tallerman (Founder & CEO at Modsy)

Series a term sheet template

I would advise spending significant time, even if one of these terms does become important later, you probably won’t be able to anticipate it at the time you are negotiating the term sheet.

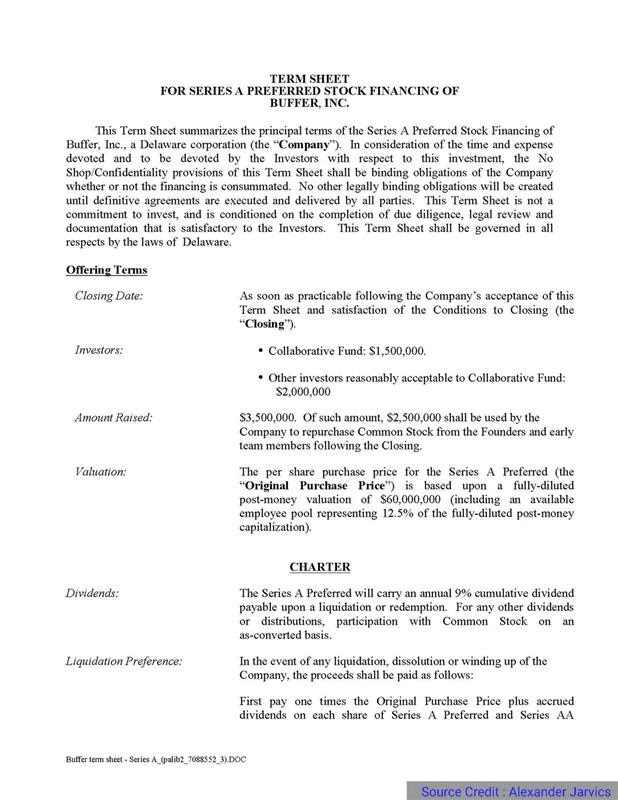

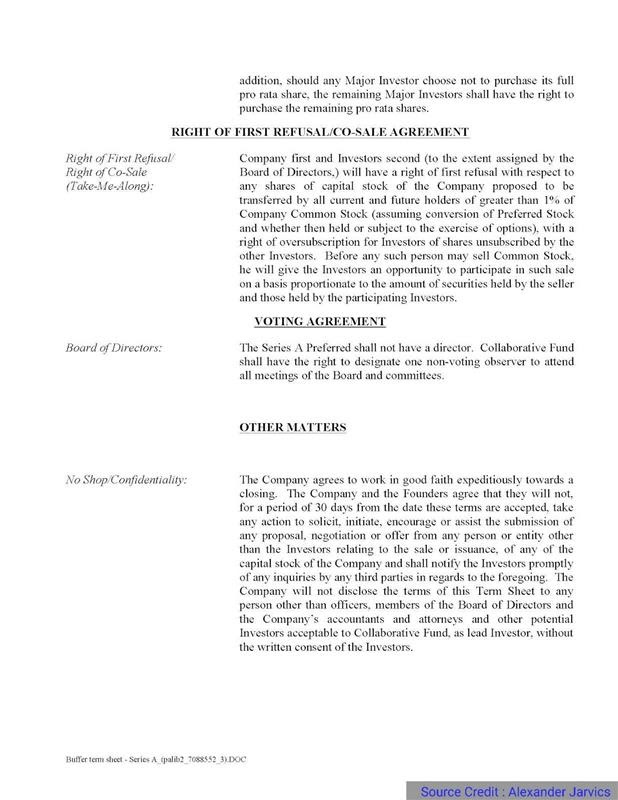

Now I will help you to understand a real-life example of a sample series a term sheet when Buffer raised a $3.5m series-A round from 2 investors in October 2015. The investors were Stage One Capital and Marc Bell Ventures.

Terms and Conditions :

Stock Type

Preferred

Dividends

The investors got a 9% cumulative dividend that is payable at redemption (stock buyback) or liquidation (sale).

Liquidation Preference

1x plus dividends (above). This is very standard except for the 9% dividend interest rate.

Protective provisions

Requires 60% of the preferred to vote on a variety of points like not to issue more shares. The issuance of debt (indebtedness) is capped at $500k that is normal too.

Anti-dilution

There is a broad-based weighted average ratchet. This means if there is a down round, the investors will not get wiped out.

Mandatory conversion

Buffer basically can’t IPO unless it is worth at least $40m. The investment was at a $60m fair valuation.

Redemption rights

Investors can compel Buffer to buy back their shares in 5 years’ tenure. The value of which is their investment and the 9% cumulative dividend. Once investors ask for this they get paid a third each year over 3 years.

Counsel and expenses

Buffer was told to have their lawyers prepare the legal documents & the documents should be based on the NVAC templates (US VC association). Buffer had to pay for the investor’s legal $25k.

Information rights

Any investor that invests more than $250k gets to have 1/ visitation rights to the office with proper advance notice, 2/ yearly and quarterly financial statements, and 3/ business plans (operating budget) for the next year at the end of every year.

Pro-rata

Normal pro-rata for Major investors ($250k investment). Also if investors don’t take up the right, the other investors get to buy them.

Right of first refusal and tag along

If more than 1% of shares are to be sold, then the investors get the right to buy the shares. If people don’t take them pro-rata then other investors can buy them. This is pretty normal.

Board

There is no director, and they can have an observer. This is not normal.

Negotiation Tactics of series a term sheet

If you’ve been reading all the way here, you’re now ready to go into term sheet negotiations. You must be wondering How long it takes to negotiate a term sheet?

So, It shouldn’t take more than a week, or even just a few days, to negotiate a term sheet, once a VC decides they want to do a deal.

Term Sheets are usually centered around 2 things:

- Control of the company

- What cash is received in the event of an exit

Furthermore, what are the negotiation tactics of series term sheets not only to get the best deal — but also to ensure the deal closes?

-

“Initiation by investors or founders”

Generally, entrepreneurs will expect an investor to issue them an investor term sheet and initiate with the terms and conditions.

It gives them some leverage in later stages and oversubscribed deals, and at the margin. Going first, last, within the middle doesn’t matter.

Not needing money right now helps. And having another real offer, from nearly as good of an investor, also quickly ends games & shrinks timelines.

-

“How much money you ought to ask”

Investors have ranges of valuations and check sizes. So if you might take $3m, but ask for $6m then the VC firm can only do a $3m check. They may just opt out.

So avoid maintaining flexibility on the amount you want to invest, especially with smaller funds (<$100m), which increases the odds a deal can be done.

-

“Raising issues ahead of time with solutions”

Remember, No VC wants to invest in a company that has raised too much money to get to a certain stage. How much is too much? $10m is too much before a Series A.

Therefore, If you have raised too much, don’t hide it. Acknowledge it and be clear you’ve talked to the existing investors.

-

Ask for a VC’s ownership target in the round

This is necessary because most VC funds have minimum ownership stakes. And in Series A funding it is buying at least 20% of the company.

Most important is just to ask. If you aren’t selling or offering enough of the company to meet a VC’s model, they may just opt out.

-

Be clear where you stand on board seats

If a VC is investing enough money for an 8%+ stake, they will often ask for a board seat. Are you OK with that? Is there a line where you are OK, and where you aren’t? Figure it out. Some VCs may pass if they can’t get a board seat.

-

A super tight deadline on a VC

When you tell a VC that has a tight deadline to meet, they will listen. But they may just walk if it is too tight. When in doubt, just be transparent on all timelines.

Use our venture capital report to evaluate your business and get access to 1000’s investors that are looking to invest in your company.

-

Support from existing investors

If your existing investors aren’t 100% supportive, that can prove to be fatal in fundraising. So, talk to them, try to line them up — and know where you stand, and where the issues may be.

Final Advice

Focus on what’s important, negotiate and resolve the important points early, get the agreement closed as quickly as possible, and move forward towards growing the company.

Educate yourself about the consequences of the various terms, and decide with your co-founders and advisors what matters most to you.

If you will argue with potential investors on every point or resist to compromise on every term, you will likely end up without a deal.

Also, keep in mind that series a term sheet in a startup’s early financing rounds can set a precedent for series b and series c funding. Future investors will anchor on the terms of the investments that preceded them.

Sure, you can Google “how to do a term sheet” but I will advise you to Get a lawyer who has experience with these kinds of deals. The lawyer will help you to review all documents and discuss terms before signing or cashing any VC checks.

Don’t forget to cover your bases with the right insurance policy for your business. Once you’re certain the investors offering you a term sheet are a good match, go beyond the obvious.