Building a startup collectively entails a lot of decision-making. Product decisions, Marketing, and Financial decisions become paramount. Founders often plan on taking their ideas forward.

Hence Startup assets and business prerequisites often take a backseat. Thus the founding team’s structure is not deliberated. This practice often gets problematic when the organization undergoes an overhaul.

Equity Split is one such important decision. If not deliberated adequately, it often poses a problem when the assets are re-allocated and ownerships are revised.

A Harvard Business Review Article rightly points out that a team has succeeded at splitting the equity when none of the founders are happy.

So in this article, we will explore the right method to split Equity. Moreover, we will also highlight why a 50-50 equity split is a bad idea.

Equity Split Through the Lens of Famous Tech Founders.

Microsoft –

When Paul Allen and Bill Gates sat to split the asset, they didn’t go for a 50-50 split. Rather as mentioned in Bill Gates’s autobiography the process was based on logic.

Paul Allen settled for 36%- 40% since Bill Gates had done more work in the initial phase.

Google –

When Google filed an IPO (Initial Public Offering), they each had a close to equal (which was 15%). Later it was speculated that it went on to be a 49-51 split between Larry Page and Sergey Brin.

Oracle-

Oracle had 3 stakeholders and the initial split was 60/20/20. Since Larry Ellison was the founder it was rationally decided that he should keep the lion’s share.

Apple-

Steve Jobs, Steve Wozniak, and Ron Wayne settled for a 45/45/10 split. Since Ron Wayne played a role a little later and was instrumental in handling the administration and logo design.

The common thread in all the examples here is that we don’t see a 50/50 split. Although it sounds the most convenient way, it’s far from a rational approach.

Equity split decisions take time mainly because of numerous factors into account. While some founders dive into it from the start, some take time to build rapport to understand the right approach.

Common Mistakes in Equity Split, Founders Make.

Various situations should be taken into consideration before deciding on the split. Some key considerations are elucidated below:-

-

Banking on Goodwill–

It is a very perilous affair to rely on goodwill. Especially if the co-founders have just met. Hence the first mistake is to ponder about equity split in the initial phases where the trust-building is still in process.

It’s a long-term commitment that could steer your corporate strategy. That said, hiring a co-founder you have just met is also a decision one should reconsider seriously.

-

Issuing a 50-50 split-

The examples stated in the previous sections of the article, it is not wise to go for a 50-50 split. Firstly equal stakes will entail difficulty in decision making. Often the founders could be at loggerheads and concluding would be tough.

In a situation where co-founders have equal stakes, business decisions are not easy to take without landing in a deadlock. Bottomline – Equity split should depend largely on value creation.

-

Not considering the Restrictions and Caveats-

Differences of opinion can crop up at any time. Sometimes co-founders decide to part ways over differences in roadmaps they wish to take.

Hence vesting restrictions is essential to make sure that the person doesn’t keep his equity stakes by serving for a short time. A restricted stock purchase agreement is the right way to ensure this.

Make sure you have a minimum cap on the year of service your co-founder needs to fulfill.

-

Not complying with Securities laws-

Founders must adhere to the laws and comply with the documentation needs. An equity split is a key decision that entrepreneurs must take to achieve their goals.

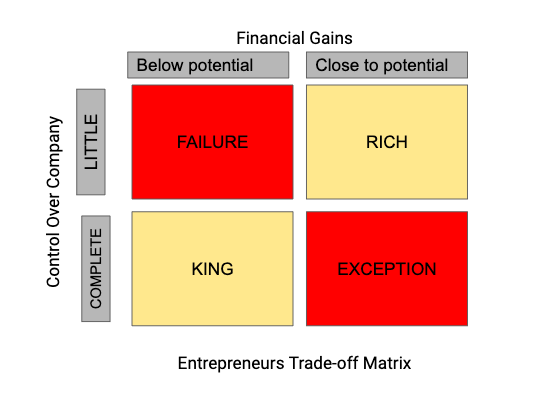

They can resort to wealth maximization and be rich or decide to take control early and be the king. A Harvard Business review article explores the decision tradeoff and the bottom line is in the Matrix below:-

Key Considerations and Calculation of Equity Split.

-

Assess the Value addition Objectively-

Value addition refers to the amount of conscious efforts to build and work towards managing and growing it. Always look out for two things.

- What are the set of skills and experience your co-founder is bringing to the table?

- What kind of vision and commitment he holds to take your company forward. This forward-looking approach will help you assess the course your company will take. Moreover, you will get an idea about the strategic and organizational challenges you might face.

-

Execution weighs more than Ideas-

Entrepreneurs believe the one who ideated is the king. However, you must meticulously plan and gauge who contributed effectively to bring the idea on paper to fruition by jumping into the market.

After gauging your Business Idea Feasibility, it is essential to gauge market readiness. After this step, the execution is a mammoth task. So always make sure the co-founders have had an equitable contribution historically.

- Who designs the business pitch most of the time?

- Which Co-founder oversees the marketing efforts from time to time?

- Whose ideas are the most relevant to the features of the service?

- Among all, which co-founder has a better relationship with the investors?

-

Co-founder’s Involvement and stature –

The key questions that you must always ask here are the following:-

- Are they committed full-time to your venture or just extend an advisory role.

- If they are instrumental in getting the key funding for Your Venture?

- Do they invest their own money wisely and balancing personal and professional commitments in terms of finances?

- Whether they are established players in the market?

- If they are the key driving force in the growth of the firm or just execute your vision and strategies?

The bottom line is Most of the equity splits consist of a major chunk of deliberations and a minor chunk of execution. Most companies offer services to calculate equity based on negotiations coupled with their Equity calculator algorithm built by experts.

Firstly the co-founders discuss and fill out a questionnaire to assess the involvement and role in scaling the business.

Secondly, Based on their responses the algorithm factors in all the necessary elements and calculates a rough estimation of the split. Thirdly, the co-founders deliberate upon the output and settle for the final split after few rounds of discussions.

Dynamic equity split model

Over the course of the life cycle of the start-up, the contributions and roles of the co-founders undergo a continuous overhaul. One of them might have had little to contribute during the inception who now plays a bigger role in driving the business.

Hence it is sometimes unfair to have a fixed equity split structure. Thus Dynamic Equity Split Model helps the co-founders to continuously assess their role and contribution.

The main idea is to take into account the monthly (or periodic) contribution of the co-founders and recalculate shares continuously.

The best way to assess this is to monitor the effort, involvement time, and thought that co-founders put into their start-up. This is known as Sweat Equity.

Under the dynamic equity split model, each cofounder has the chance to continuously earn shares. Hence this model opens doors for motivated teamwork and continuous revision of roles and responsibilities.

It also paves way for a fair negotiation backed by evidence and objective analysis of contribution.

Pros and Cons

The following are the essential areas where you can benefit as a co-founder-

- You can plan out your split by analyzing reasons objectively and hence deliberations don’t tend to be controversial.

- Quantification of People’s contributions. Thus this helps to rule out any ambiguity while assessing co-founder involvement.

- The system addresses co-founder departures (resign or fire) and loss of equity due to the departure. This is important.

- Periodic review of the split allows co-founders to be on their feet and work with motivation.

- Motivates the co-founders to up-skill themselves to contribute largely to the start-up at various stages.

However, the downsides are important as well. The following are the areas that the co-founders should take into account before resorting to a dynamic model.

- It minimizes the value of the “idea”. It has value and some value should be assigned to it unless the idea originated from all of the co-founders.

- The model will face difficulty in assessing and assigning values to the contributions that aren’t a factor of time and money (for example- building good investor relations or building a healthy rapport with the clients.)

- Time is not always the right measure of involvement. A co-founder putting in 100 hours may not be as efficient as his co-founder who puts in 80 hours but is twice as efficient.